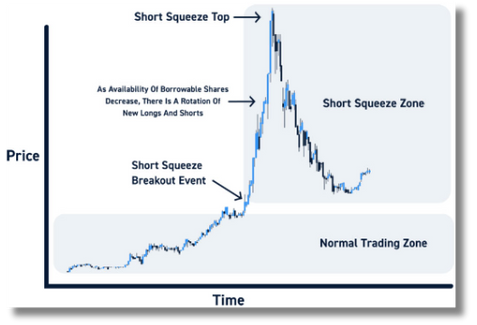

A short squeeze happens in financial markets when the price of an asset rises sharply, causing traders who had sold short to close their positions. This occurs when a security has a significant amount of short sellers, which means that a large group of investors are betting on it to fall in price. A short squeeze begins when the price of an asset unexpectedly jumps higher, and continues to gain momentum as a significant number of the short sellers decide to cut their losses and exit their positions

GME as a meme stock and what drives meme markets:

A meme stock describes a stock that gains significant attention and price momentum due to viral trends on social media platforms rather than its financial fundamentals. GameStop (GME) is an American based brick-and-mortar video game retailer that had been struggling for years due to the rise in digital gaming and the COVID-19 pandemic’s impact on physical retail sales. G stock price had been declining steadily over a few years as a result.

On the subreddit r/WallStreetBets (WSB), a community of retail investors began discussing GameStop heavily. Users noticed that the stock was heavily shorted by institutional investors, meaning these investors were betting that the stock’s price would fall further. Some Reddit users, notably Keith Gill (known as “Roaring Kitty” on YouTube), argued that GameStop was undervalued and that if enough retail investors bought the stock, they could trigger a “short squeeze,” forcing those who bet against the stock to buy it back at higher prices, driving the stock’s price up.

In January 2021, GameStop’s stock price skyrocketed from around $4.5 (USD) to over $480 (USD) in a matter of days. This was largely driven by a combination of retail investors buying the stock and short sellers being forced to cover their positions. The rapid increase in the stock’s price drew widespread media attention, and more retail investors jumped on board which further fueled the price surge. The stock’s extreme volatility led to trading platforms like Robinhood restricting the purchase of GameStop and other meme stocks, causing outrage among retail investors. The event sparked debates about market manipulation, the power of retail investors, and the role of social media in stock trading.

The GameStop saga led to increased scrutiny from regulators and sparked a broader movement of retail investors using social media to influence stock prices, leading to the rise of other meme stocks like AMC Entertainment and BlackBerry.

Other meme stocks and social media fuelled markets:

AMC Entertainment (AMC):

Background: AMC is an American movie theatre chain that struggled during the COVID-19 pandemic as theatres were forced to close.

What Happened: Like GameStop, AMC became popular on social media platforms, especially Reddit, where retail investors rallied to support the stock. Its price surged from around $10 (USD) in early 2021 to around $260 (USD) by June 2021.

Impact: AMC used the opportunity to raise capital by issuing new shares, which helped the company avoid bankruptcy and stabilise its business.

BlackBerry (BB):

Background: Once a dominant player in the smartphone market, BlackBerry shifted its focus to cybersecurity and software services after its hardware business declined.

What Happened: BlackBerry became a meme stock in early 2021, with its stock price rising significantly as retail investors speculated on its future prospects.

Impact: The surge in BlackBerry’s stock price was less dramatic than that of GameStop or AMC, but it still reflected the power of social media-driven trading.

Bed Bath & Beyond (BBBY):

Background: Bed Bath & Beyond is an American home goods retailer that struggled with declining sales and store closures.

What Happened: The stock became a target of retail investors in early 2021 and again in 2022, driven by speculation and short squeeze potential. The stock saw significant price volatility, with large spikes in response to social media discussions.

Impact: Despite the price surges, Bed Bath & Beyond continued to face financial challenges and eventually filed for bankruptcy in 2023.

What drives meme stock prices and why are they so volatile:

Social Media Hype:

Viral Discussions: platforms like Reddit, X, TikTok, and Discord can amplify discussions about a particular stock. When a stock becomes the subject of widespread conversation, especially in communities like WSB, it can attract a large number of retail investors.

Meme Culture: memes simplify complex financial concepts and create a sense of community and excitement, which makes investing feel accessible and fun. This culture can drive a herd mentality, leading many to buy a stock simply because others are doing so.

FOMO (Fear of Missing Out):

Momentum Investing: as the stock price begins to rise, more investors jump in to avoid missing out on potential gains. This creates a feedback loop where rising prices attract more buyers, which pushes prices even higher.

Media Coverage: News outlets and financial media often pick up on these surges, which can lead to even greater FOMO as the stock receives more attention.

Retail Investor Behaviour:

Commission-Free Trading: platforms like Robinhood make it easy for retail investors to trade without fees, leading to higher trading volumes. Accessibility and Leverage: The ease of access to markets and the ability to use options or margin calls to leverage positions can amplify buying pressure on a stock.

Speculation and Rumours:

Catalysts: speculation about potential positive news, like a turnaround in the company’s business, new products, or celebrity endorsements, can fuel demand.

Rumours: unverified or exaggerated claims about a company’s future prospects can spread quickly on social media, driving up prices.

Retail Investor Behaviour:

Low Supply of Shares: some meme stocks have a relatively low float, meaning there aren’t many shares available for trading. When demand spikes, this limited supply can cause prices to increase rapidly.

The work of R/WallStBets and how their diamond hands turned GME into the biggest financial craze of the 21st century:

r/wallstreetbets (WSB) is a Reddit forum where members discuss and share ideas about buying and selling stocks, with a particular focus on speculative trades. It is known for its bold and sometimes controversial strategies, often involving stocks with high volatility or those that are heavily shorted by institutional investors.

r/wallstreetbets (WSB) is a Reddit forum where members discuss and share ideas about buying and selling stocks, with a particular focus on speculative trades. It is known for its bold and sometimes controversial strategies, often involving stocks with high volatility or those that are heavily shorted by institutional investors.

WSB was created in 2012 by a Reddit user known as Jaime Rogozinski. The forum gained mainstream recognition in early 2021 during the GameStop short squeeze. Many institutional investors had shorted GameStop stock, betting that its price would fall. However, members of WSB began buying up shares and options, driving its price up excessively. This forced the hedge funds to buy back shares at much higher prices to cover their positions, resulting in massive financial losses for the short-sellers and substantial gains for some retail investors.

WSB users commonly trade a financial derivative known as an option contract. An option is just that; It gives the holder of the contract either the option to either buy (call) or sell (put) a specified stock on or before a specified date at a specified price. The reason these contracts are so common on WSB is because they give traders access to high amounts of leverage as one option contract controls 100 shares of stock.

Jaime has published a book called WallStreetBets: How Boomers Made the World’s Biggest Casino for Millennials. where he talks about his perspective on the modern day stock market and how many reckless investors use wall street like a casino while playing with money that they can’t afford to lose.

The GME short squeeze, as it happened:

Pilot:

GME had been facing significant financial difficulties for years. As the gaming industry evolved and digital sales increased, GameStop’s business model, reliant on physical stores, appeared increasingly outdated. Financial analysts and institutional investors observed this decline and concluded that GameStop was not a viable long-term investment. Seizing on this, they began betting against the stock, a strategy known as short selling. This involved borrowing GameStop shares, selling them at the current price, and planning to repurchase them later at a lower price, hoping the stock would fall.

The Initial Drop:

As these investors publicly declared their bearish outlook, GME’s stock price began to decline. The increased selling pressure, along with negative sentiment greatly eroded the stock’s value. However, this bearish consensus was not universally accepted.

The Unexpected Turnaround

Contrary to the bearish predictions, some investors noticed that performance was better than anticipated. This realisation led to a surge in buying activity from retail investors (mostly from WSB) who saw an opportunity. As demand for GME shares increased, the stock price rose and rose.

The Squeeze

The rise in GameStop’s stock price created a dilemma for those who had shorted the stock. As the price climbed, short sellers were forced to buy back shares at higher prices to cover their positions This buying frenzy further propelled the stock price upward, creating a feedback loop of escalating prices and creating panic among short sellers.

The Volume of Shorts and Market Impact

The situation intensified as the volume of short positions exceeded the number of GameStop shares available in the market. This discrepancy worsened the volatility and led to even more dramatic price swings. Observers and investors became increasingly aware of the mismatch between the number of shares shorted and those actually available

Institutional Commitments and Skyrocketing Prices

Now, institutional investors who had shorted the stock were compelled to buy shares at any price to cover their positions, especially as the company avoided bankruptcy or a buyout by an equity fund. This forced buying at inflated prices pushed GameStop’s stock to un-realistic levels, far beyond its intrinsic value. The stock’s rapid rise attracted further interest from retail investors, fueling additional buying and contributing to an unsustainable price surge.

The Inevitable Correction

While the stock price soared, the underlying fundamentals of GameStop did not justify such valuations. Investors and analysts knew that the stock would eventually correct itself. The market’s reaction to the short squeeze was a striking example of how collective action, market sentiment, and institutional pressures can create extreme volatility in financial markets.

within their respective communities, while the company’s leadership oversees the broader vision and operations of the platform.

How WSB and retail investors forced ‘Hedgies’ to lose their ‘Tendies’:

High amount of Losses: During the GameStop (GME) short squeeze, hedge funds that had bet against the stock faced massive financial losses. Melvin Capital saw a 53% decline in its portfolio value in January 2021 and required a $2.75 billion bailout from other funds. Overall, the short squeeze led to billions of dollars in losses for funds involved in shorting GME, with estimates suggesting that the total impact could have exceeded $5 billion.

Margin Calls: Since their brokerage account was under the minimum required amount (obviously), their brokers kept demanding additional capital to cover the increasing value of their short position. Melvin Capital faced crazy margin calls due to its significant short position in GME. The hedge fund reportedly needed to raise approximately $3 billion to meet these margin calls.

Forced Liquidation: Hedge Funds now had to meet Margin Calls and Liquidation requirements. This meant they had to sell their investments and basically get money the quickest way possible. Since Melvin Capital required a $2.75B (USD) bailout from other funds, selling pressure contributed to high market volatility, with major indices like the S&P 500 and Nasdaq Composite experiencing increased fluctuations. The forced asset sales by multiple hedge funds also caused declines in specific stocks within their portfolios, increasing market disruptions and reflecting the wider impact of the hedge funds’ attempts to manage their financial pressure.

Where is Melvin Capital today?

Today, the asset management giant is gone. On May 18th 2022 founder Gabriel Plotkom annouced that the fund would shut down by June 2022. At the time of Melvin’s this annoucement, assets under management was around $7.8B (USD). It is estimated that during the GME short squeeze, due to their high amount of short positions, they experienced loses of one billion and overall had a loss of around $6.8B (USD). Before the GME short squeeze, Melvin Capital was one of the highest performing funds on Wall St, recording a return of 44% in 2019 and that number grew to 52% at the end of 2020. Melvin Capital’s down fall from grace shows us the dangers of short selling and not being able to cover your potential losses.

Robinhood; taking from the poor, giving to the rich?

During the GME short squeeze, brokerage platforms (companies that allow individual investors to invest in the stock market) halted trading of GME shares, quoting high volatility as the main reason why. Two of the largest brokerages in the US, Robinhood and Webull halted buying of GME shares but would allow people who already owned shares to sell. So why exactly did they do this? When someone places a buy order of a share, it’s up to the brokerage to ‘post’ a percentage of the trade as collateral. Usually these collateral requirements are 0.5%-1% of the value of the trade. However, due to the extreme volatility of GME during its short squeeze, brokerages were asked to post up to 100% of the trade’s value. While this makes sense on paper, many retail investors who wanted to buy GME saw this denial from their brokerages as a way to shield institutional investors to give them the ability to sell their holdings of GME so they weren’t squeezed from the rapidly climbing prices.

Damn, that was crazy… So what now?

Currently, GME trades at $35.86 (AUD). While nowhere near its short squeeze high of $120.75 (Note that GME has had a 4:1 stock split between now and the squeeze) but it still multiples above its before squeeze price of around $1.50. Recently GME has seen a small rally in its price which can partly be explained by Keith Gill’s (Roaring Kitty’s) post on X the day before. With GME earnings being released this Tuesday (10/09/2024) it will be a tell to see how much of GME’s stock price is based on strong business fundamentals and how much is backed by the hype of the craziness that has occurred the past four years. GME’s forecasted EPS (Earnings Per Share) is forecasted to be very low compared to usual companies, with estimated ranging from -$0.06 to $0.02 and revenue estimates are aiming in the range of $1.34B to $1.40B.

Overall, GME’s future as a sustainable investment looks questionable and could go in either direction. It’ll be up to the markets how they treat GME; will they treat it as another craze and cause the stock to fall even more from its short squeeze highs, or will it lift GME up, placing it at the forefront of every investor’s, whether from Wall St or Wall St Bets mind.